Get the facts about your credit score

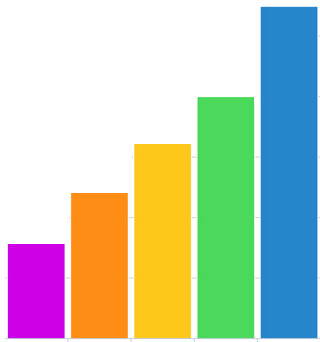

Range of scores:

A = greater than 740

B = 739 to 680

C = 679 to 640

D = 639 to 600

E = less than 599

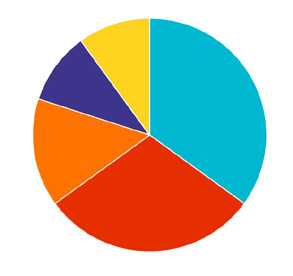

What makes up your score?

- 35% = payment history

- 30% = amount of debt

- 15% = length of credit

- 10% = new credit (in last 12-18 months)

- 10% = mix of credit (installment vs. revolving)

What hurts your score?

- Missing payments.

- Credit cards at capacity.

- Shopping for credit excessively.

- Opening multiple accounts in a short time frame.

- Borrowing from finance companies (Payday loan stores).

- Closing credit cards out.

- Having more revolving vs. installment debts.

How do you improve your score?

- Pay off or pay down your credit cards.

- Don’t close credit cards.

- Move revolving debt into installment debt.

- Continue to make timely payments.

- Slow down on opening new accounts.

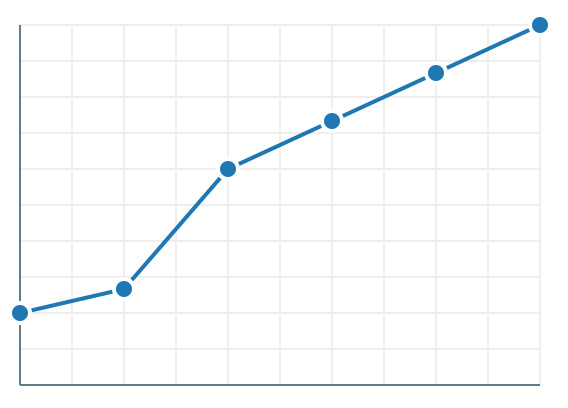

Approximate credit weight for each year?

- 40% = current to 12 months

- 30% = 13-24 months

- 20% = 25-36 months

- 10% = 37+ months