Staying on top of your credit has never been easier.

All within our online banking and app, access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your credit score.

You can do this ANYTIME, and ANYWHERE and for FREE.

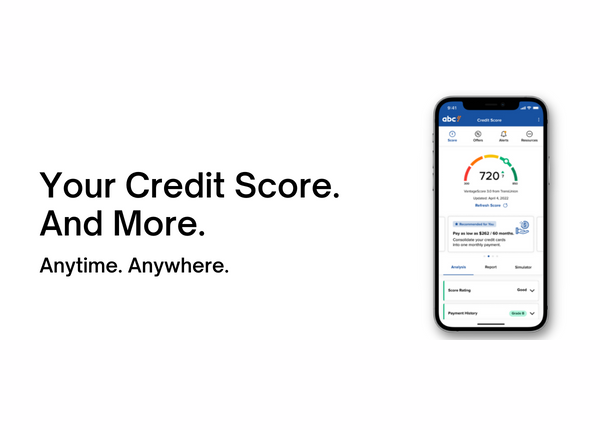

Benefits of Credit Score:

- Daily Access to your Credit Score

- Real-Time Credit Monitoring Alerts

- Credit Score Simulator

- Personalized Credit Report

- Special Credit Offers

- And More!

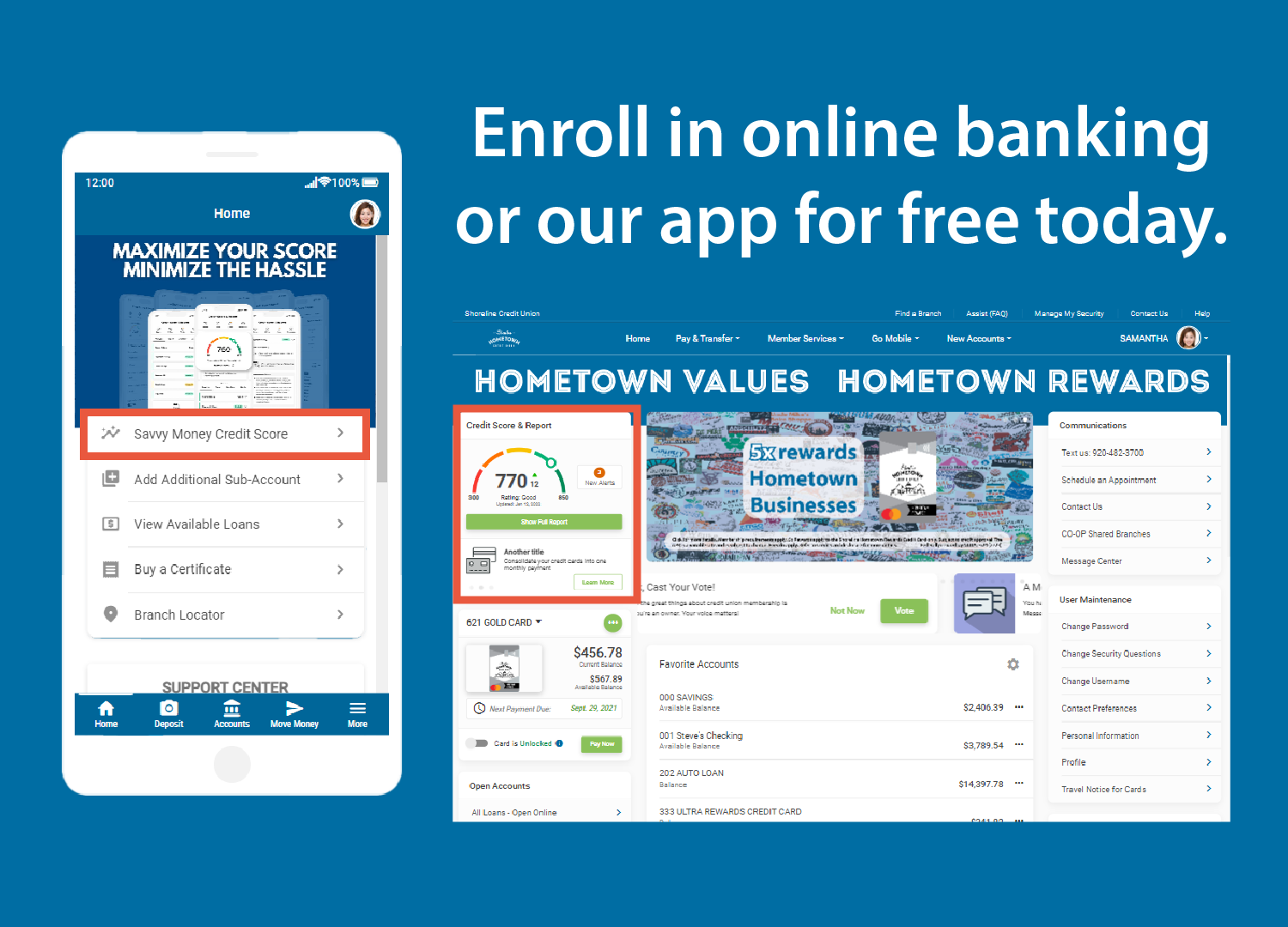

Find your score, enroll today.

Log into online banking or our mobile app and enroll. It is located in the home menu of the app, and left menu of online banking.